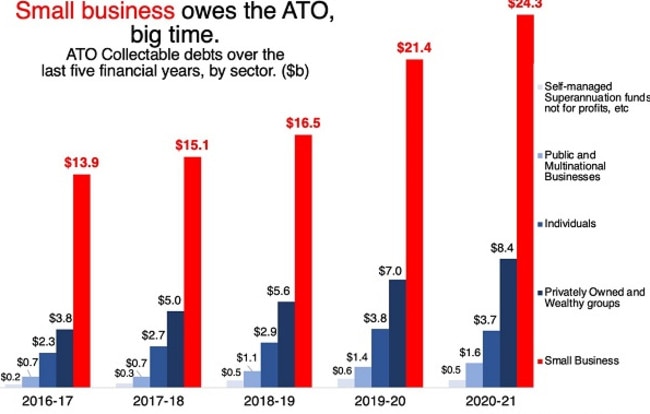

Tax time is here and after two years of being chill, the taxman just got serious. No more Mr Nice Guy. The level of debt small business owes to the tax office has got out of hand and they are coming to collect.

The ATO has been sending out friendly warning letters, and over 20,000 taxpayers have responded by paying up or getting on payment plans.

Which has got a little bit back. “Around $4 billion or so already,” ATO Deputy Commissioner Jeremy Hirschhorn said on May 19. But taxpayers who don’t respond to the letters shouldn’t expect the ATO to give up.

Small business owes a lot to the Australian Taxation Office. Picture: Jason Murphy

“Where taxpayers don’t engage, the ATO is taking firmer actions,” he said.

In the pandemic, the ATO pitched in to help the economy. It chose not to send businesses broke by not chasing debts. Back then, government was handing out money to business and nobody cared about raising revenue. The priority was saving jobs and livelihoods. Now, however, new Treasurer Dr Jim Chalmers is looking at a trillion dollars in debt. He’s going to need all the money the ATO can find to try to improve the budget balance.

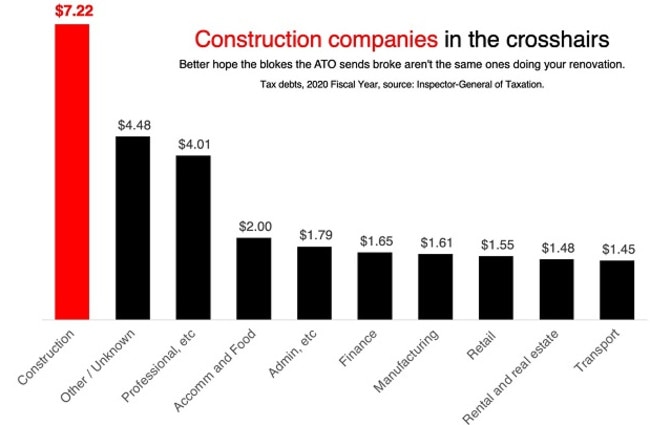

Where can the ATO find that money? By following the Hiluxes. That’s right, the biggest sector that owes money to the taxman is tradies (and developers). Construction. They owed a staggering $7.22 billion in the 2020 fiscal year, as the next chart shows. If the ATO got that back we could pay for about half of one of our new nuclear submarines.

The biggest sector who owes the taxman cash is construction. Picture: Jason Murphy

“Our initial focus will be on taxpayers with higher debts before including taxpayers with all other debts,” ATO deputy commissioner Vivek Chaudhary said.

In recent times, the ATO has been sending out 30-40 letters every day called Director Penalty Notices. If you get one of these, you’re in massive trouble. It means you need to pay up, or they will start some very damaging processes. In the worst case scenario, if you can’t or won’t pay, the ATO sues you in court, you lose, they liquidate your business, and because your business loan is secured against your house you lose your house too. (Around half – 49 per cent – of small business loans are secured against residential property.) You end up with legal bills to pay, no business and nowhere to live.

Actually, that’s maybe not quite the worst case scenario in dealing with the ATO. The worst case is you do have somewhere to live but there are bars on the windows and you can’t leave … Yes, the ATO is putting people in the slammer if they do the wrong thing. Jail. The Big House.

To be fair, if you ended up in jail it will be for more than just not paying a debt. But if you’ve been up to something dodgy, beware. For example, a swimming teacher was given a three year jail sentence in May this year for sending in $250,000 in fake claims for GST refunds. She’s in the Brisbane Women’s Correctional Centre right now. And she had to repay the money. The number of prosecutions the ATO pursued collapsed during Covid but they are likely to bounce back now.

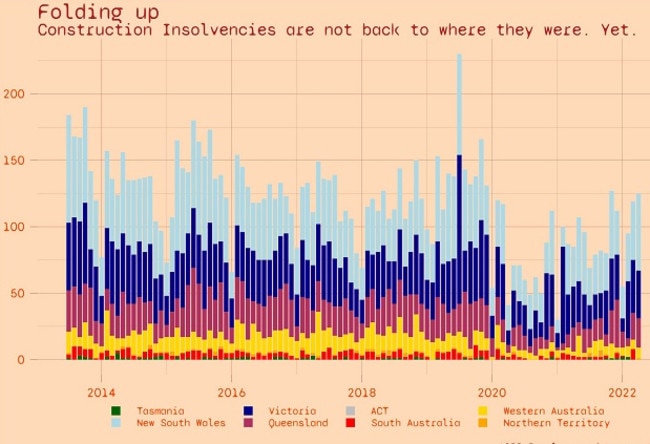

Most debtors will simply pay their ATO debts back. The ATO is good at arranging payment plans so you can pay them back over time. But some businesses will owe more than they can pay and go broke.

As the next chart shows, there have been relatively few construction insolvencies in the last two years.

There have been relatively few construction insolvencies in the last two years. Picture: Jason Murphy

The reaper put his scythe away. Some businesses that would normally have been thinned out were instead given a chance to carry on. Some have done well, others only appear to have done well.

If you take into account what they owe to the taxman, they were probably better off folding a while ago.

As 2022 goes on, expect a fair few Hiluxes to be repossessed by the bank and a few construction projects to stall as the businesses running them go bust.

If debts with the ATO affect you, please contact our office for help.

By Jason Murphy from News.com.au