Electric vehicles (EV) represent just under 2% of the new car market in Australia but it is a rapidly growing sector with a 62.3% jump in new EV registrations between 2020 and 2021.

Making EVs FBT-free is just the first step in the Government’s plan to make zero and low emission vehicles the car of choice for Australians, focusing on affordability and overcoming “range anxiety” by:

- Cutting import tariffs

- Placing EV fast chargers once every 150 kilometres on the nation’s highways

- Creating a national Hydrogen Highways refuelling network, to deliver stations on Australia’s busiest freight routes

- Converting the Commonwealth fleet to 75% no-emissions vehicles

It is on this last point, fleet cars, that the FBT exemption on EVs is targeted. The Government can control what it purchases and has committed to converting its fleet to no-emission vehicles, but for the private sector, there is a wide gap between the total cost of ownership of EVs and traditional combustion engine vehicles. It’s more expensive overall and the Government is looking to reduce that impediment through the FBT system.

How the EV FBT exemption will work

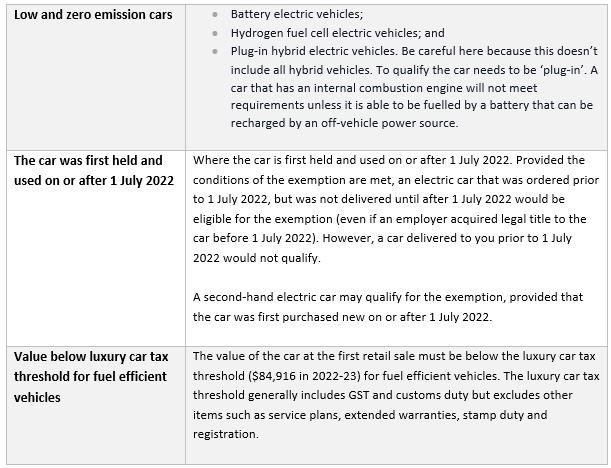

The proposed FBT exemption is intended to apply to cars provided by an employer to an employee under the following conditions:

If an electric car qualifies for the FBT exemption, then associated benefits relating to running the car for the period the car fringe benefit is provided, can also be exempt from FBT.

If an electric car qualifies for the FBT exemption, then associated benefits relating to running the car for the period the car fringe benefit is provided, can also be exempt from FBT.

Government modelling states that if an EV valued at about $50,000 is provided by an employer through this arrangement, the FBT exemption would save the employer up to $9,000 a year.

While the measure provides an exemption from FBT, the value of that fringe benefit is still taken into account in determining the reportable fringe benefits amount of the employee. That is, the value of the benefit is reported on the employee’s income statement. While income tax is not paid on this amount, it is used to determine the employee’s adjusted taxable income for a range of areas such as the Medicare levy surcharge, private health insurance rebate, employee share scheme reduction, and social security payments.

Who cannot access the FBT Exemption?

Your business structure makes a difference

By its nature, the FBT exemption only applies where an employer provides a car to an employee. Partners of a partnership and sole traders will not be able to access the benefits of the exemption as they are not employees of the business. When it comes to beneficiaries of a trust and shareholders of a company it will be important to determine whether the benefit will be provided to them in their capacity as an employee or director of the entity.

Exemption is limited to cars

As the FBT exemption only relates to cars, other vehicles like vans are excluded. Cars are defined as motor vehicles (including four-wheel drives) designed to carry a load less than one tonne and fewer than nine passengers.

Note: The material and contents provided in this publication are informative in nature only. It is not intended to be advice and you should not act specifically on the basis of this information alone. If expert assistance is required, professional advice should be obtained.